On an adjusted basis, Lightspeed reported a loss of US$11.2 million or nine cents per diluted share for its most recent quarter compared with an adjusted loss of US$5.6 million or six cents per diluted share a year ago.

It attributed US$31.2 million of the increase in revenue to ShopKeep and UpServe. Its revenue doubled to US$82.4 million, up from US$36.3 million. dollars, said the loss amounted to 34 cents per diluted share for the quarter ended March 31, compared with a loss of 21 cents per diluted share a year earlier when it had fewer shares outstanding. The company, which keeps its books in U.S. Yet Lightspeed's fourth-quarter net loss was more than double the US$18.6 million loss it reported in the same quarter a year. "Improving the payment economics for these acquisitions was always a priority, but in this case, we achieved our goals earlier than anticipated," he said. ShopKeep and UpServe, he said, had high levels of penetration within their own customer bases when acquired, but their economics were "inferior" to Lightspeed's.ĭasilva used Lightspeed's increased scale to secure better terms with one of the company's payments providers, improving the economics for the acquisitions. The firm earned 133.20 million during the quarter, compared to analysts' expectations of 124.17 million. The reported (0.08) earnings per share for the quarter, beating analysts' consensus estimates of (0.10) by 0.02.

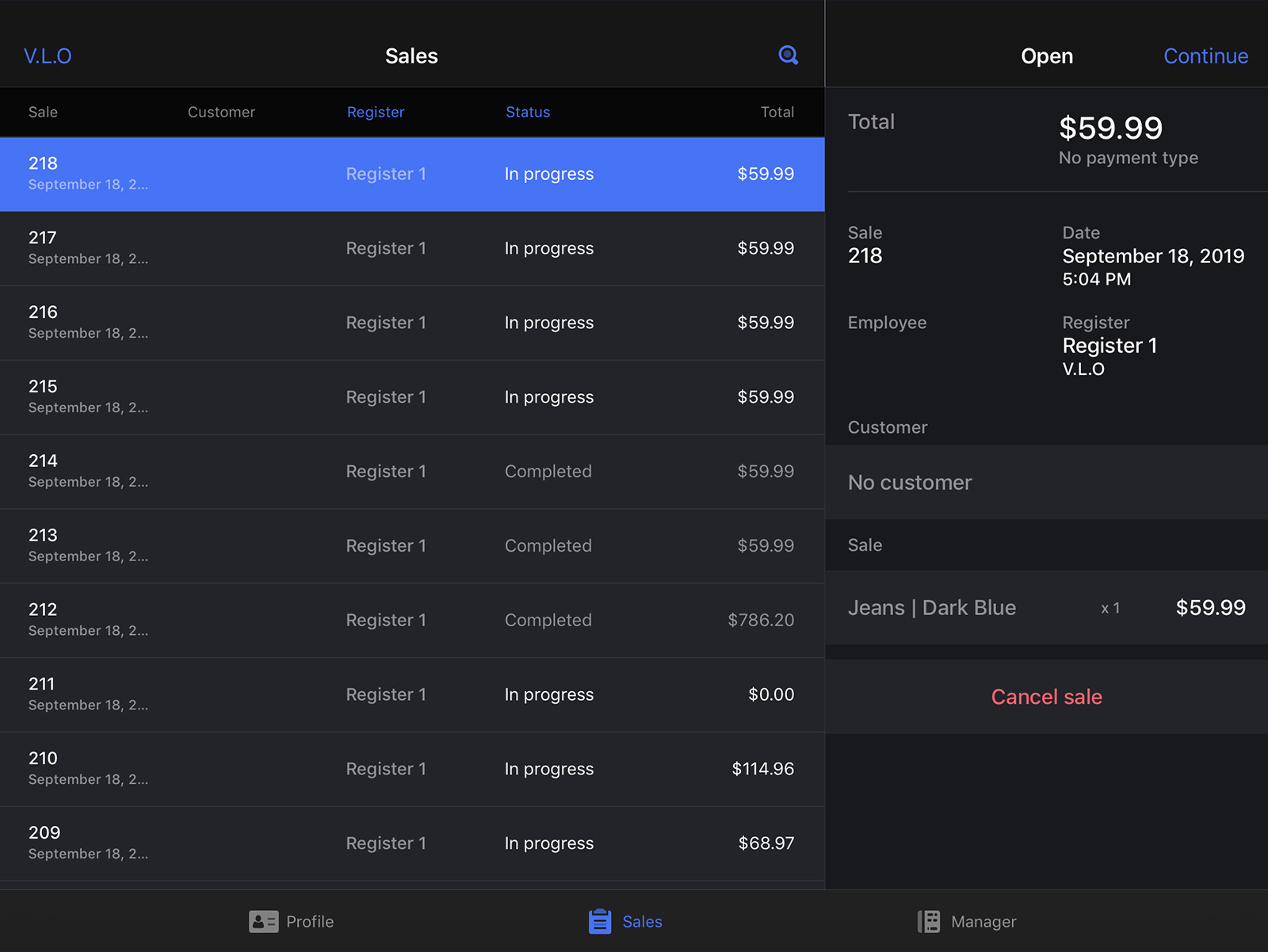

#Lightspeed pos software

Founded in 2005 as a retail point-of-sale software vendor, LSPD was born just about the same time as commerce software giant Shopify (TSX:SHOP. Lightspeed POS last posted its earnings data on November 4th, 2021. "Over-time we should continue to recognize the benefits of our M&A strategy across our entire business." Lightspeed POS is a founder-led TSX tech stock. "M&A has always been part of our strategy, but in the last six months, it's been front and centre," Dasilva said. Lightspeed POS is one of the most popular and trending POS system available in the market. The deal followed the US$440-million acquisition of ShopKeep, which helps restaurants and retailers accept payment and manage their business, as well as the purchase of restaurant software company Upserve. Last month, Lightspeed closed its deal to buy New Zealand-based Vend Ltd., a cloud-based retail management software company. The company, which sells software for small and medium size retailers and restaurateurs, spent much of the last year helping its clients adopt e-commerce offerings to deal with the pandemic and a soaring interest in online shopping. "As we exited (the quarter), we saw some regions begin to lift those restrictions and March proved to be a very strong month," he told analysts on a conference call Thursday. to report a US$42 million net loss in its latest quarter, but the company believes a rebound is starting to materialize.ĭax Dasilva, the chief executive of the Montreal e-commerce business, said his company's fourth quarter began with many provinces and countries implementing stay-at-home orders to quell COVID-19, but ended with a bright spot. MONTREAL - COVID-19 lockdowns keeping shoppers home pushed Lightspeed POS Inc.

0 kommentar(er)

0 kommentar(er)